Do you need a new TV or ref just because the old one decided to give up on you after 10 years? As much as you want to buy a new one, you’re short in cash and there are bills waiting to get paid.

This is where Home Credit gets in the picture. A part of Home Credit group, Home Credit Philippines offers financing services through non-cash and no-collateral in-store financing. If you happen to have little or no credit history, Home Credit can still extend credit to you to help you boost your rating.

Despite the promise of easier loan application, we noticed that not everyone who applies get approved. Some even claim that they have higher income yet they don’t get the result they were hoping for. To help you in this dilemma, we listed several tips to help you get approval from Home Credit.

Tip No. 1: Pay off overdue or unpaid loans from other creditors.

Just like any other lenders, Home Credit uses the information from the SEC’s Credit Information Corporation. This means they can see who you owe money to, how much, and how frequent you pay your creditors. Any signs of unpaid loan/s is a red flag for them, thereby affecting your loan application.

“But I have other loans from other lenders,” you might say. That’s fine, as long as you pay on time.

Tip No. 2: Disclose existing financial obligations.

You might be scared to tell Home Credit that you have existing personal loan from Bank A and a housing loan from Bank B. You badly need to credit, so you want to make your record to look as clean as possible.

Don’t do that. Again, Home Credit uses the CIC, which means they can see your credit history. Even if you don’t disclose, they will most likely find out about it and take it against you; hence the rejection of your loan application.

Tip No. 3: Pay a higher downpayment.

Yes, Home Credit extends a helping hand so you can buy the item/s you need. Still, this doesn’t mean the responsibility lies solely on them.

One of the secrets for getting approved is by paying a higher cash-out. If you can provide the highest downpayment, then there is a higher chance of approval. The good thing about this is that you will have lower instalment every month.

Tip No. 4: Let them know about what you own.

It’s not bragging. It’s about telling a potential creditor that you are capable of paying a loan and that they have nothing to worry. One of the issues mentioned by previous Home Credit clients is that Home Credit asks for referrals and will call them in case of delay in payment. You can prevent this from happening by disclosing your assets.

Tip No. 5: Don’t forget your ID.

Home Credit requires two primary IDs, such as:

- Driver’s license

- SSS ID

- UMID

- Passport

- PRC ID

- Voter’s ID

If you are unable to submit two IDs, then you can support it by presenting a secondary ID like utility bills, company ID, credit card, TIN ID, NBI clearance, Philhealth card, salary slip, or barangay clearance.

Tip No. 6: Pay Home Credit earlier and not on the due date itself.

This has been a common practice among Filipinos. Unfortunately, it’s not a good sign for lenders, including Home Credit. If you plan to re-apply, Home Credit will appreciate if you pay BEFORE the scheduled due date. This will speed up loan processing as well.

Still, this doesn’t mean that following these tips will guarantee 100 percent approval. At the end of the day, it will all depend on Home Credit and everything we listed here serve as a guide to increase your chances of getting approved.

Good luck!

Cashalo is a financial marketplace that gives borrowers like you an access to financial products that you can use for personal use or investment with the lowest interest rate.

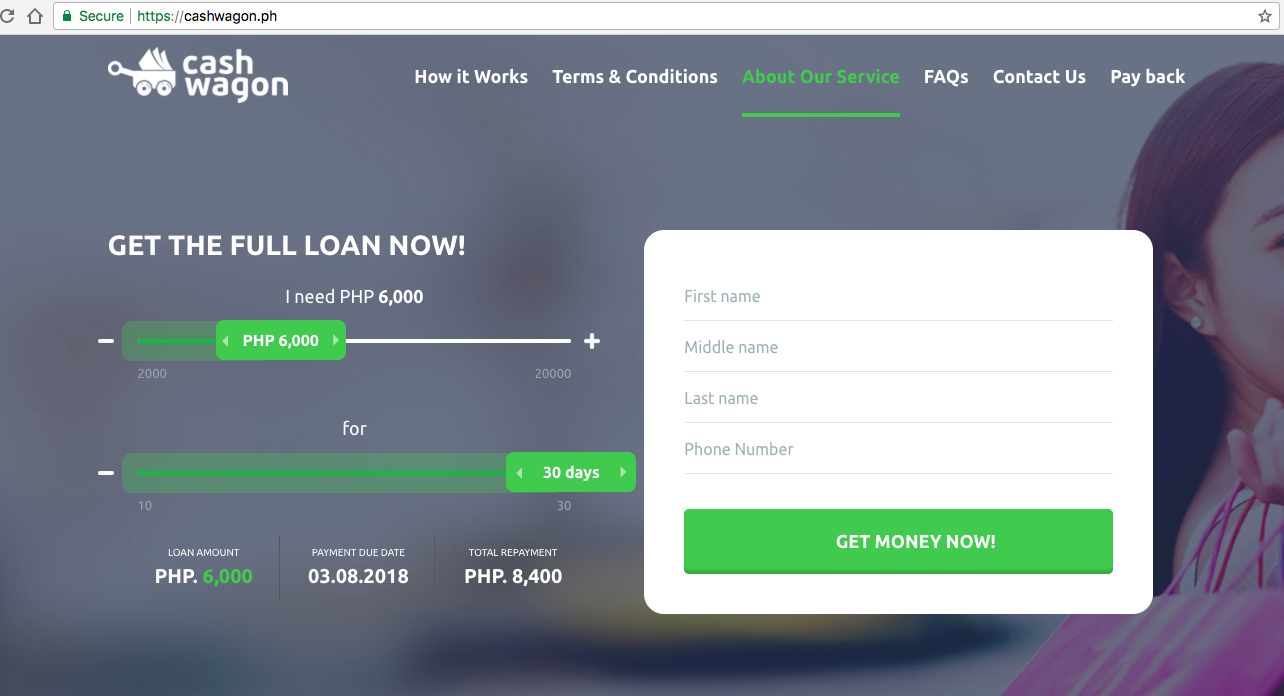

Cashalo is a financial marketplace that gives borrowers like you an access to financial products that you can use for personal use or investment with the lowest interest rate. Who is Cashwagon?

Who is Cashwagon?

Recent Comments