Online cash loans are popular these days. This type of facility offers convenience and ease in application – something traditional banks cannot offer (yet). Can you imagine this: applying for a loan without leaving the comfort of your own home?

One of the popular online cash lenders these days is Moola Lending. It is a Philippine-based financial technology company under Doctor Cash, which has several fin-tech companies in Asia. The company promises rapid processing of loan application, simple application procedure, and transparency in dealing with borrowers.

The question now is this: Does Moola Lending live up to its promise? Here’s what customers have to say about it:

On Applying for a Loan

The borrowers interviewed said the same thing: applying for a loan was easy and convenient. Application and submission of loan form is coursed online. Simply go to their website to apply for a loan and you will get an answer as soon as possible. Some borrowers were able to get an approval on the same day while there are others who were contacted by Moola representatives a day or two after the loan application was submitted.

Repeat loan is also possible. One borrower shared that she was able to borrow four times from Moola and her experience was good. She was also able to get a higher amount because she was a repeat customer.

Though you have to be cautious in disclosing your employment. One borrower, Richard, initially chose “Freelance” and was rejected.

On Receiving the Cash Borrowed

Moola borrowers had different experiences in receiving the cash they borrowed. One borrower, Steph, said that she received the amount the day after she was informed that her loan was approved and the money was credited to her account.

On the other hand, most of the borrowers interviewed said that it took days before they received the amount. Even if the Moola Customer Support informed that the amount was already credited in the indicated bank account during your application, you have to wait for at least a day and send a follow-up to make sure that your loan was processed.

On Interest and Other Charges

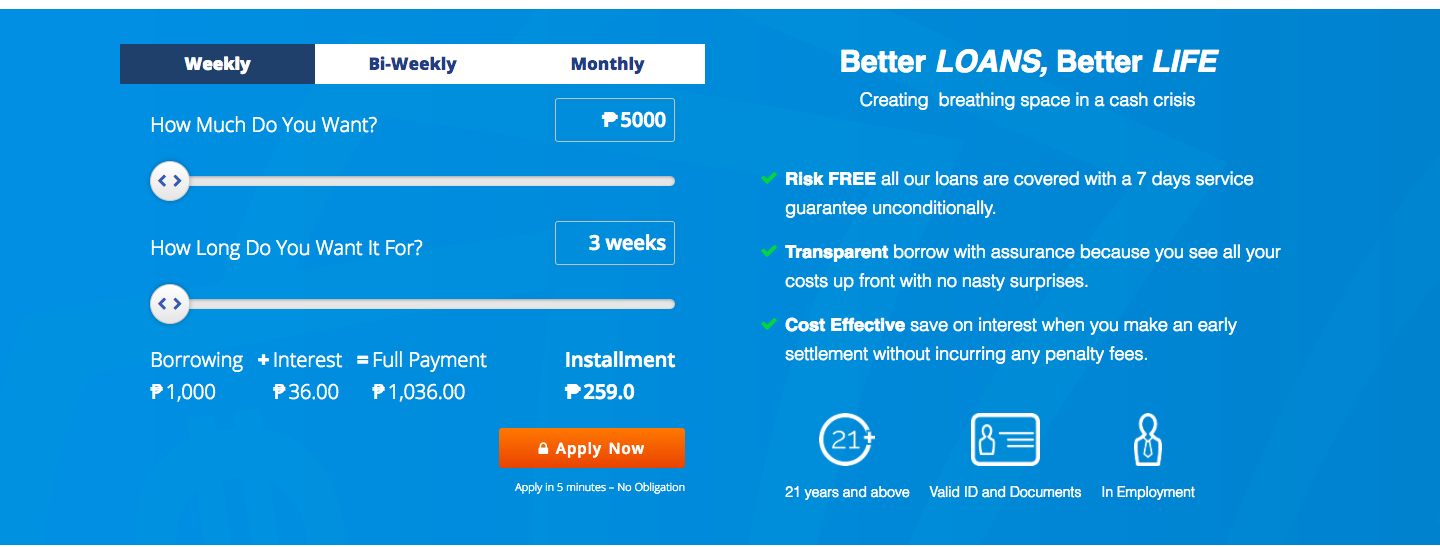

All borrowers interviewed said the same thing about interest: it’s too high. Some borrowers also said that Moola has one of the highest interest rates compared to the other online cash loan providers they tried. Take the case of Jocelyn, another borrower. She applied for a P5,000.00 loan for 30 days, the interest she paid was P1,500.00.

Moola also charge 10 percent Handling Fee, which is automatically deducted in your loan amount. Lina, one of the borrowers interviewed mentioned that despite the P3,000 loan, only P2,700.00 was credited to her account. This means when you borrow P5,000 from Moola, deduct the 10 percent of it and that is the amount you will see in your account.

On Loan Repayment

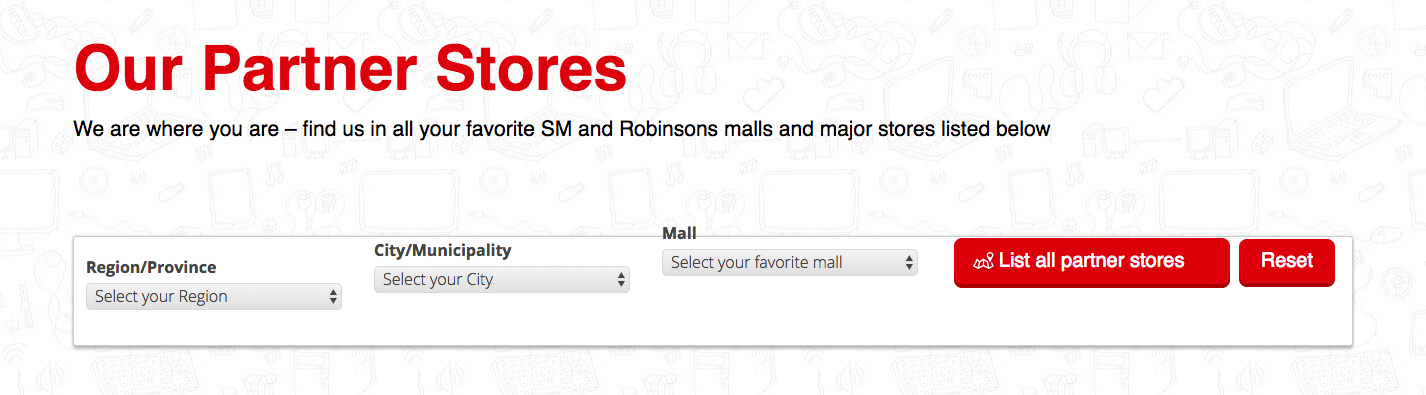

Payment of loan is through over-the-counter payment at partner branches and DragonPay via 7/11, LBC, Cebuana, SM Department Store, SM supermarkets, or Robinson’s Payment Center. DragonPay was the method used by all of the borrowers’ interviewed in paying for the loan, which requires a specific reference number per client for easier tracking.

Because of the Handling Fee and high interest rate, the borrowers are expected to pay higher amount compared to the actual amount borrowed. In the case of Lina, she will pay a total of P3,630.00 even if her loan was only P3,000 and P2,700 was credited to her account.

Another issue raised by several borrowers was the term. Even if you chose 30 days as your loan term, which is also the maximum term, theirs was only for 21 days. When Jay, also another Moola borrower, asked about the changes in the loan term, he was informed by the customer support that the system automatically calculates the term of the loan.

On Customer Service

When it comes to customer service, the borrowers are divided. There are borrowers who praised Moola Customer Support because of their fast response, both through their Facebook page and e-mail. On the other hand, there were customers who received no reply from their customer support, especially when raising concerns about their loan application.

Overall, not all borrowers had a pleasant experience borrowing from Moola Lending. Even if their loan application was approved faster compared to other online cash loans lenders, it took days before they were able to withdraw the money from their account. The 21 days loan term instead of 30 days that was initially applied for, payment of 10 percent handling fee, and high interest rate are also big issues, which is why most borrowers don’t recommend Moola.

Have you tried Moola? Please comment to post your experience here!

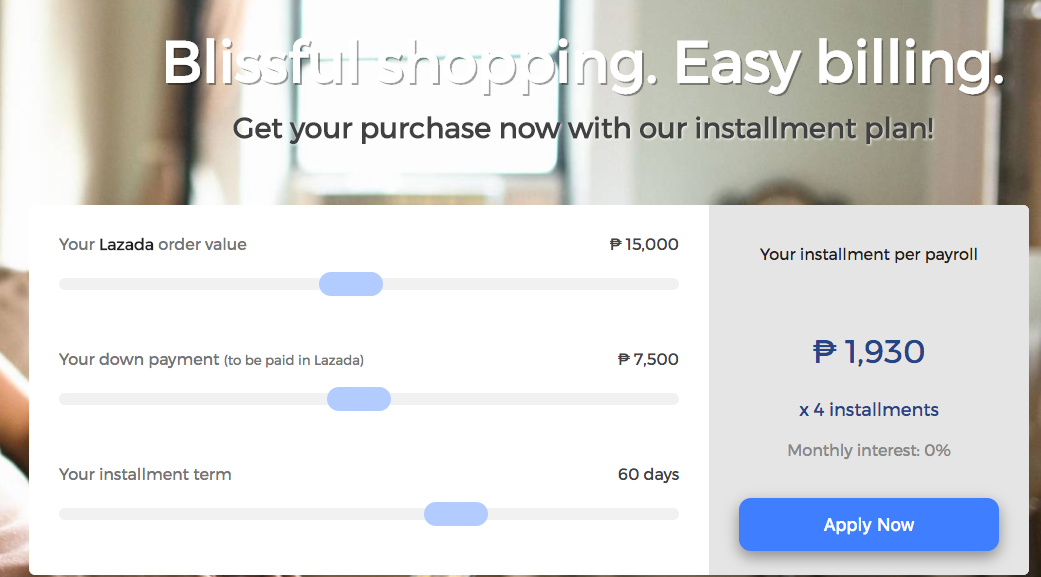

Akulaku is an Internet-based company focused on e-commerce and online financial services in Southeast Asia, specifically Indonesia, Malaysia, and Philippines. The company also takes pride in being the first online shopping mall that offers installment as among the modes of payment. In fact, you can pay in installment basis even without a credit card.

Akulaku is an Internet-based company focused on e-commerce and online financial services in Southeast Asia, specifically Indonesia, Malaysia, and Philippines. The company also takes pride in being the first online shopping mall that offers installment as among the modes of payment. In fact, you can pay in installment basis even without a credit card.

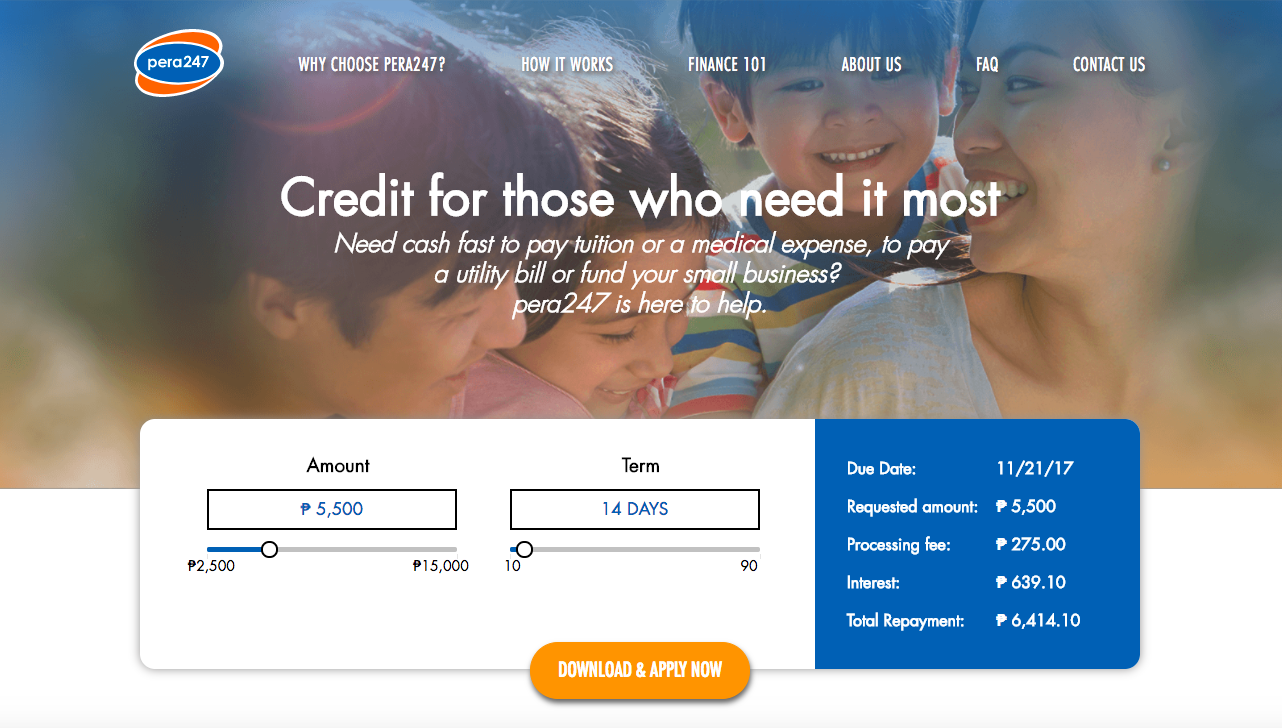

Who is pera247?

Who is pera247?  What is Security Bank’s Salary Advance Loan?

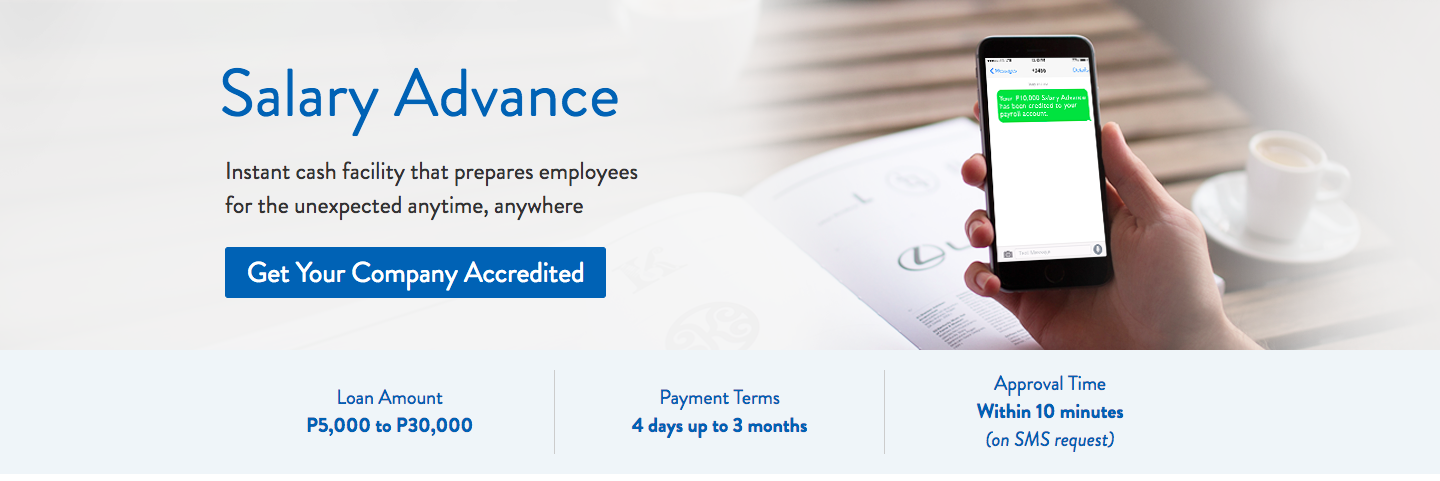

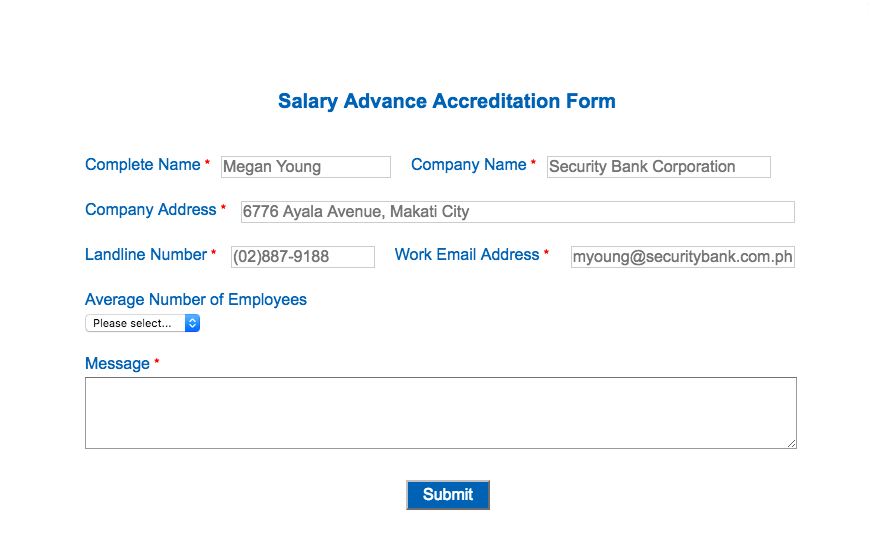

What is Security Bank’s Salary Advance Loan?  For companies who wish to be accredited by Security Bank, you can submit the Salary Advance Accreditation Form and other documents for accreditation such as Memorandum of Agreement (MOA) and Secretary’s Certification or Board Resolution showing the authorized signatories of the company.

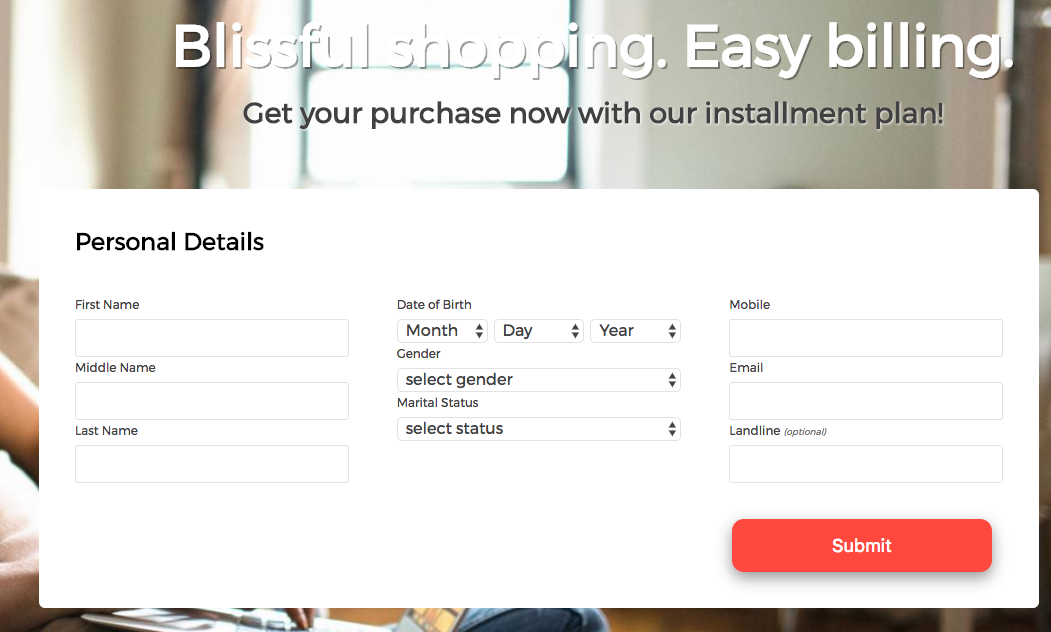

For companies who wish to be accredited by Security Bank, you can submit the Salary Advance Accreditation Form and other documents for accreditation such as Memorandum of Agreement (MOA) and Secretary’s Certification or Board Resolution showing the authorized signatories of the company. Here’s how you can apply for a loan:

Here’s how you can apply for a loan:

Who is Home Credit Philippines?

Who is Home Credit Philippines?

Recent Comments