Shop Now, Pay Later With TendoPay

Have you ever had that experience when you want to purchase a product but you can’t because:

- You don’t have much cash with you, or

- You don’t have a credit card.

Frustrating, isn’t it. As much as you want to apply for a credit card so you could buy big items and pay for it in installment, you can’t. Sadly, you need to have a bank account first and you need to establish that you are a worthy borrower.

Not that you’re not worthy, but banks can be picky. If you can’t back up your payment capacity, then you need to look into other means, just like the Buy Now, Pay Later scheme offered by online lenders.

The BNPL scheme targets unbanked Filipinos who don’t have access to credit cards. Through BNPL, you can make purchases from any of the lender’s partner merchants and pay for the item in equal monthly installments. This could range from a month to 12 months, depending on the lender.

Speaking of lender, there is one that is getting popular these days – TendoPay.

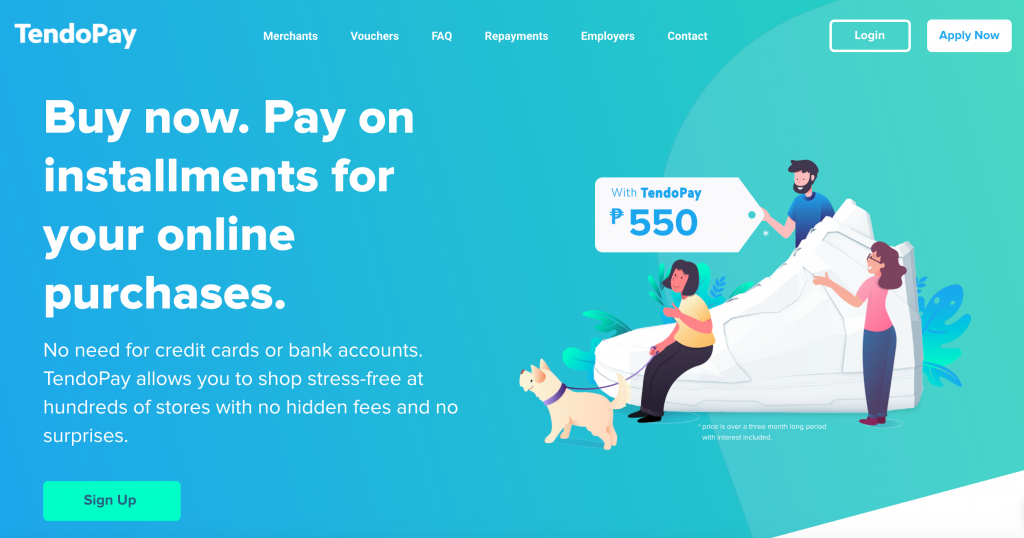

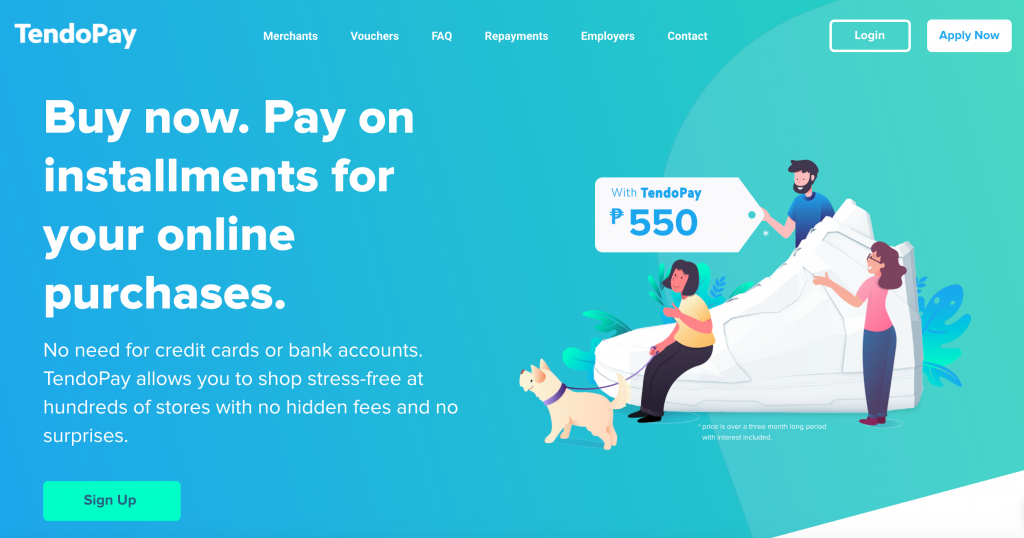

What is TendoPay?

What is TendoPay?

TendoPay is an installment plan solution that allows customers to pay for online purchases in two to 24 monthly installments.

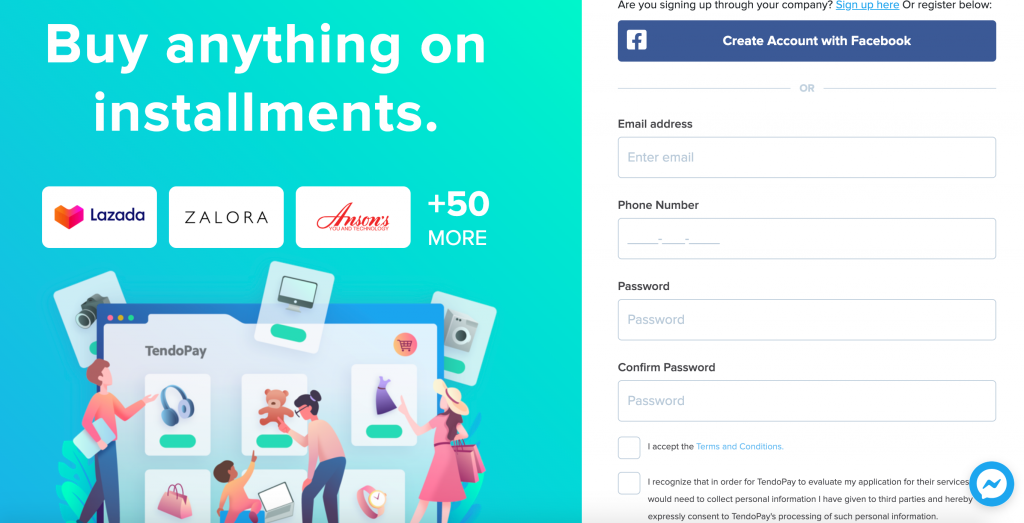

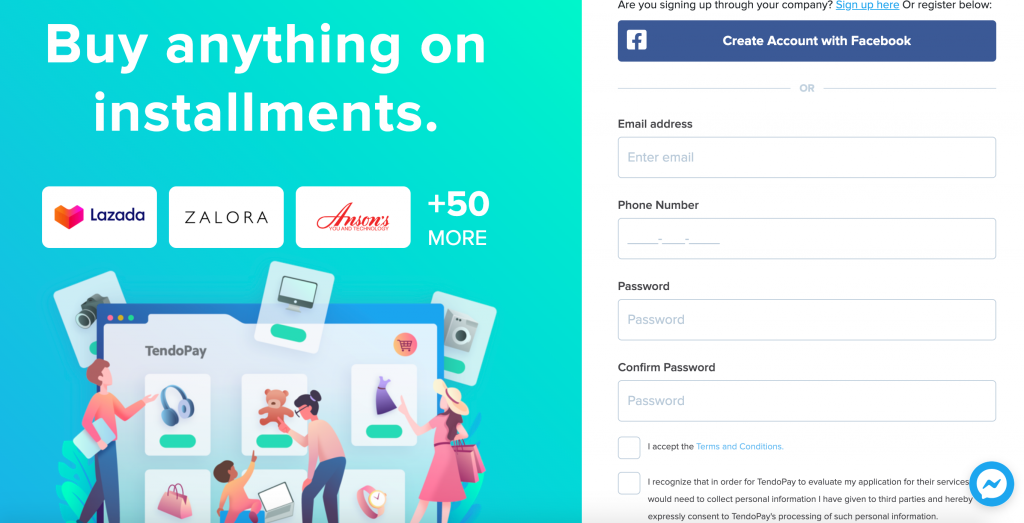

To apply, you can either:

- Create an account through their website. Take note that the approval isn’t automatic. All required documents must be uploaded first in order for TendoPay to review your account. You will be informed of the status of your registration after 48 hours (or earlier, depending on the volume of applications). Once approved, you can now start shopping at TendoPay partner merchants.

- Use TendoPay as your payment method every time you make a purchase from their e-commerce merchant partners. You will still be required to register and fill out an online application form before TendoPay can process your installment application.

As of this writing, TendoPay’s growing list of partner merchants include Lazada, Anson’s, Zalora, Royal Gem, Hapi Homes, Harman Kardon, Data Blitz, Kimstore, and Henry’s Camera among others. You can check the complete list of merchants here.

TendoPay Employee Benefit Program

This is an innovative benefit that employees will love. Employers can apply for this program wherein their employees can be entitled to:

- TendoPay virtual credit card, which they can use when making purchases online

- No minimum salary threshold, which means all regular employees are qualified

- Credit limit is up to 75 percent of gross monthly income for first-time users. This could go higher depending on frequency of loan and payment behavior

- Low interest rate starting at 2 percent, with some partner merchants charging zero percent interest

- Fast approval for all regular employees

- Loans will be managed by TendoPay

TendoPay Installment Loan Features

- Loan amount between P3,000 and P30,000, although the maximum loan amount can only be increased depending on the frequency of borrowing and when borrower makes timely payments

- Loan term between two and 24 months

- No upfront fees

- Loan application process will take a maximum of one business day from the time all documents are submitted or uploaded

- Sending of notifications to ensure that no installment will be paid late

- Various repayment channels including 7-Eleven, Cebuana Lhuillier, LBC, Bayad Center, SM Payment Center, ECPay, GCash, PayMaya, and Robinson’s Department Store

What are the things I need to remember before I apply with TendoPay?

- Borrower must be of legal age at the time of the loan application

- With valid email address and mobile number

- Upload a copy of a government-issued ID like Driver’s License, SSS ID, Passport, PRC ID, and UMID

- Utility bill such as electric or water bill that is not older than three months. This should also reflect your address for verification purposes.

- Proof of income like pay slip or Certificate of Employment that is not older than two months

TendoPay is available nationwide. This means wherever you are, you can have access to this financial service and make shopping easier.

Just make sure to pay your installments on time so you could get an increase in your credit limit.

What is TendoPay?

What is TendoPay?